Payroll Giving For Nonprofits: The Ultimate Fundraiser’s Guide

In the ever-evolving landscape of fundraising, nonprofits and other charitable groups are constantly on the lookout for innovative methods to grow and sustain their financial support. One such method that has gained significant traction in recent years is payroll giving.

This powerful tool empowers employees to regularly contribute a portion of their salaries to their nonprofit organizations of choice, creating a steady and reliable income stream for the causes they care about.

In this guide, we’ll explore payroll giving, its value to nonprofits and other program stakeholders, and how your organization can leverage this method to boost its fundraising efforts.

- What Is Payroll Giving? The Basics

- A Quick Look at the Payroll Giving Process

- Payroll Giving by the Numbers: Inspiring Statistics

- The Payout of Payroll Giving: Key Benefits to Know

- 5 Companies With Standout Payroll Giving Programs

- How to Implement a Successful Payroll Fundraising Strategy

Ready to see how your nonprofit can benefit from payroll giving and beyond? Let’s dive in at the beginning.

What Is Payroll Giving? The Basics

Payroll giving, also known as Give As You Earn (GAYE), is a type of workplace giving program that allows employees to make donations to nonprofit organizations directly from their paychecks.

These donations are typically deducted before taxes, making it a convenient and tax-efficient way for individuals to support causes they care about.

A Quick Look at the Payroll Giving Process

Payroll giving is a straightforward and efficient way for employees to donate to charitable organizations directly from their paychecks. Here’s how the payroll deduction process typically works:

1. Program Setup by the Employer

The employer first partners with a payroll giving provider or integrates the program into its existing payroll system. This provider manages the distribution of employee donations to the selected nonprofits.

From there, the employer may either select a list of eligible charities that align with the company’s values or allow employees to choose any nonprofit organization registered through the platform.

2. Employee Enrollment

The employer then promotes the payroll giving program to employees, explaining the benefits, how it works, and the impact of their contributions on various nonprofit causes. Employees interested in participating sign up for the program, often through a dedicated online portal provided by the payroll giving provider.

3. Donation Selection

Employees select the nonprofit(s) they wish to support, determining the amount (whether in dollars or by percentage) they wish to contribute from each paycheck.

4. Payroll Deduction

Once enrolled, the chosen donation amount is automatically deducted from the employee’s paycheck each pay period, generally before taxes are applied. The employer’s payroll department handles the deduction and transfers the total amount to the nonprofit

5. Fund Distribution

The payroll giving provider collects all employee donations and distributes them to the selected nonprofits on behalf of the employees, typically on a biweekly, monthly, or quarterly basis.

Payroll Giving by the Numbers: Inspiring Statistics

Payroll giving is a powerful tool for both corporations and nonprofits. Interested in exploring its potential? The following statistics make a compelling case for Give As You Earn programs, illustrating their potential to boost engagement and impact alike.

- Workplace giving campaigns (including payroll giving) raise an average of $4-6 billion annually.

- Nearly 2 in 3 surveyed employers match employee payroll deductions, ultimately doubling the value of each individual gift.

- 18% of survey respondents indicate that their employers offer payroll giving as a way to support nonprofit causes.

- There’s been a 7% decrease in payroll giving performance year over year, highlighting an opportunity for growth in the programs.

- 59% of survey respondents currently remain unfamiliar with payroll giving programs.

- More than 30 million UK employees qualify for payroll giving programs through their employers.

- Of those who qualify for payroll giving, only an estimated 8-10% actually participate in the programs.

- Donors contribute an average of $141 million through payroll deductions each year.

Sources: America’s Charities, Charities Aid Foundation, Fidelity Charitable, Double the Donation

The Payout of Payroll Giving: Key Benefits to Know

Payroll giving is more than just a convenient way for employees to support their favorite causes—it’s a strategy with significant benefits for businesses, nonprofits, employees, and the community at large.

Let’s discuss some of the key advantages of such a program here.

For Nonprofits

1. Steady and Predictable Income. Payroll giving provides nonprofits with a consistent flow of donations, making it easier to plan and budget for the future. Unlike one-time donations, which can fluctuate throughout the year, payroll contributions are regular and dependable.

2. Increased Donor Retention. Employees who participate in payroll giving programs are more likely to remain loyal donors. The convenience of automatic deductions encourages sustained giving over time, leading to higher donor retention rates for nonprofits.

3. Expanded Reach. Partnering with companies to implement payroll giving programs can help nonprofits reach new audiences and increase their visibility. Employees who might not have been familiar with the organization before may become long-term supporters as a result of participating in payroll giving.

4. Simplified Fundraising. Payroll giving is relatively easy to administer, especially when compared to other forms of donation collection. Many payroll giving platforms even handle the processing and distribution of funds, freeing up nonprofit staff to focus on mission-critical work.

5. Increased Credibility. Being included in a company’s payroll giving program can enhance a nonprofit’s credibility and reputation. Employees are more likely to trust and donate to organizations that have been vetted and endorsed by their employer.

For Companies

1. Enhanced Corporate Social Responsibility. Payroll giving programs demonstrate a company’s commitment to social responsibility or CSR. By facilitating charitable giving among employees, companies can align their business practices with positive social impact, strengthening their CSR profile and enhancing their reputation.

2. Increased Employee Engagement and Satisfaction. Offering payroll giving as a benefit can boost employee morale and job satisfaction. Employees are more likely to feel valued and connected to their employer when they can support causes they care about through a simple, company-sponsored program.

3. Attracting and Retaining Talent. Companies that promote philanthropy and social responsibility are more attractive to potential hires, particularly younger workers who prioritize values-driven work environments. Payroll giving programs can help in recruiting and retaining top talent who seek employers with a strong commitment to making a difference.

4. Positive Brand Image and Public Relations. By publicly supporting charitable causes, companies can enhance their brand image and generate positive media coverage. Payroll giving programs are often highlighted in CSR reports, marketing materials, and press releases, reinforcing the company’s image as a socially responsible organization.

5. Strengthened Relationships with Nonprofits and Communities. Payroll giving often leads to stronger partnerships between companies and nonprofits. These relationships can create opportunities for collaboration on community projects, volunteer events, and cause-related marketing campaigns, further embedding the company in the community it serves.

For Employees

1. Convenience and Simplicity. Payroll giving makes charitable donations easy and hassle-free. Employees can set up automatic deductions from their paychecks, ensuring consistent support for their chosen nonprofits without needing to remember to make separate donations.

2. Tax Efficiency. Donations made through payroll giving are typically deducted before taxes, reducing the employee’s taxable income. This tax-efficient method allows employees to maximize their contributions while enjoying immediate tax benefits.

3. Empowerment and Personal Fulfillment. Employees feel empowered when they can contribute to causes they care about. Payroll giving allows them to support their favorite charities regularly, leading to a sense of personal fulfillment and pride in making a positive impact.

4. Alignment with Personal and Company Values. Participating in payroll giving programs enables employees to align their personal values with their professional lives. When employees see their company supporting charitable efforts that resonate with them, it reinforces their connection to the company’s mission and culture.

5. Potential for Increased Impact. Many payroll giving programs are paired with corporate matching gift initiatives, where the company matches the employee’s donations. This not only increases the impact of their contributions but also encourages employees to give more, knowing their donations will go even further.

5 Companies With Standout Payroll Giving Programs

Payroll giving programs are a powerful way for companies to support charitable causes while fostering a culture of philanthropy within their workforce.

Here are five companies that have implemented noteworthy payroll giving programs that your organization should know about.

Payroll Giving Company #1: Costco Wholesale

Costco Wholesale offers a robust payroll giving program that reflects its commitment to community support. Employees can easily contribute to a variety of nonprofits through automatic payroll deductions.

Costco Wholesale offers a robust payroll giving program that reflects its commitment to community support. Employees can easily contribute to a variety of nonprofits through automatic payroll deductions.

The payroll giving program encourages higher participation and amplifies the support for the causes that Costco employees care about. Additionally, the company frequently engages its workforce in charitable activities, further fostering a culture of giving.

Payroll Giving Company #2: JPMorgan Chase

JPMorgan Chase has established a comprehensive payroll giving program that aligns with its broader corporate social responsibility (CSR) efforts. Employees are encouraged to donate to eligible nonprofits directly from their paychecks, with JPMorgan Chase providing matching contributions to boost the impact.

JPMorgan Chase has established a comprehensive payroll giving program that aligns with its broader corporate social responsibility (CSR) efforts. Employees are encouraged to donate to eligible nonprofits directly from their paychecks, with JPMorgan Chase providing matching contributions to boost the impact.

The program is designed to make giving easy and rewarding, with a focus on supporting a diverse range of causes that resonate with the company’s global workforce.

Payroll Giving Company #3: CVS Health

CVS Health’s payroll giving program is an integral part of its mission to promote health and well-being in communities. Employees can contribute to a wide selection of charities directly through payroll deductions, with the company offering a matching gift program to increase the impact of these donations.

CVS Health’s program is designed to be flexible, allowing employees to support the causes they are most passionate about, particularly those related to health and wellness. The company’s focus on accessible giving options reflects its commitment to making a positive difference in society.

Payroll Giving Company #4: 3M

3M’s payroll giving program is a cornerstone of its long-standing tradition of corporate philanthropy. The program allows employees to donate to a variety of nonprofit organizations directly from their paychecks.

3M matches these contributions, often doubling or even tripling the amount, depending on the charity. This matching program not only increases the overall impact of donations but also encourages widespread participation among employees.

Payroll Giving Company #5: Warner Bros. Discovery

Warner Bros. Discovery offers a dynamic payroll giving program that aligns with its global commitment to social responsibility. Employees can easily donate to their preferred charities through payroll deductions, and the company provides matching contributions to maximize the impact.

Warner Bros. Discovery’s program emphasizes creativity and social impact, encouraging employees to support a wide range of causes that reflect the company’s diverse and inclusive culture. The program is part of the company’s broader efforts to leverage its influence and resources to drive positive change in communities worldwide.

How to Implement a Successful Payroll Fundraising Strategy

Implementing a payroll giving fundraising plan can be a game-changer for organizations looking to enhance their efforts with corporate giving programs. By proactively targeting payroll deduction opportunities, nonprofits and other charitable groups can secure consistent, long-term funding, deepen donor relationships, and tap into new avenues of support within corporate environments.

Consider the following steps to build your strategy.

Register for companies’ payroll giving systems.

Most companies organize their payroll giving programs through dedicated giving platforms or CSR software. This allows the companies’ employees to simply log on, choose their pre-approved charities, and initiate their regular gifts.

That said, it’s a good idea for organizations to take proactive steps to become registered nonprofits with the solutions their donors use to give.

Top tip: This guide provides an overview of key giving platforms and how your organization can register for each one.

Raise awareness about payroll giving to donors.

Next, it’s essential to promote payroll giving opportunities to your audience of supporters. After all, tons of eligible individuals have no idea their employers make it so easy to give. Simply sharing the opportunity will drive registrations and funds for your cause.

To do so, start by providing clear information on how the programs work, the impact donors’ dollars will have on your mission, and even the tax benefits they can receive from their paycheck deductions. Use various communication channels, such as email campaigns, social media, and in-person presentations, to spread the word about these programs!

The more donors who are aware of payroll, the more donors are ultimately going to opt to get involved.

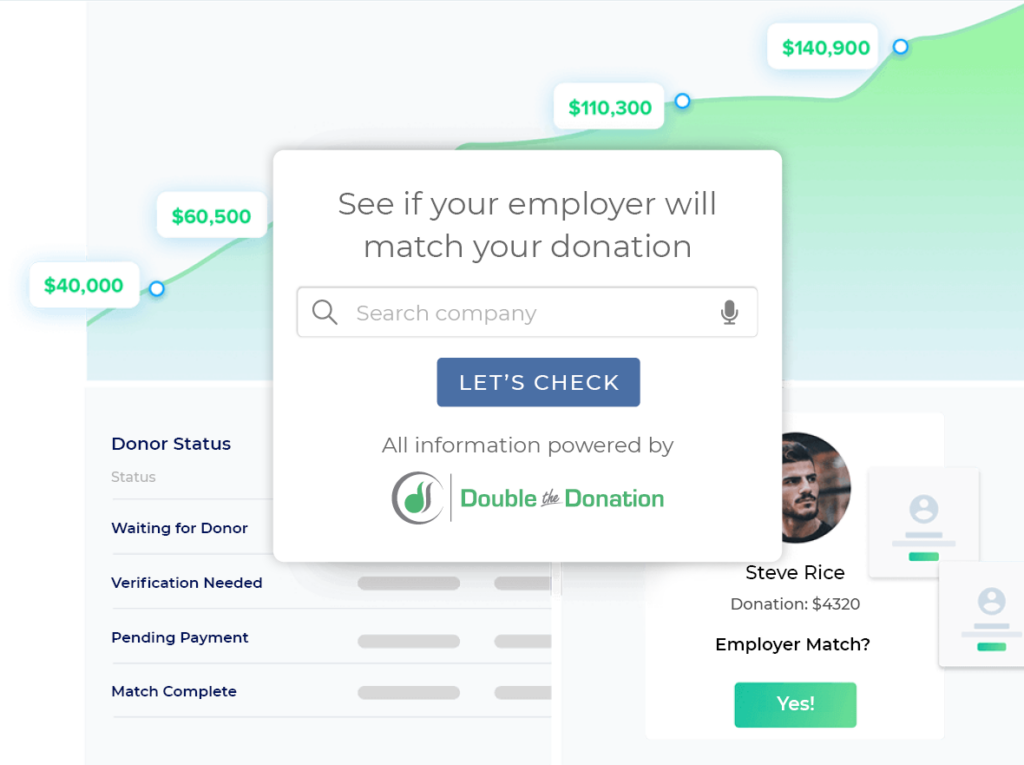

Share matching gift information as well.

Many companies offer to match employee donations, effectively doubling or tripling the impact of the initial gift. If your supporters are giving through payroll giving programs, make sure they know to consider matching gifts, too!

The easiest way is with a matching gift database search tool—all an individual has to do is enter the name of their employer and see if the company matches gifts. From there, they can even access program guidelines and request forms to simplify the process.

And if an employee doesn’t qualify for a matching gift, see if they’d be interested in advocating for a new program to their employer!

And if an employee doesn’t qualify for a matching gift, see if they’d be interested in advocating for a new program to their employer!

Offer recognition and incentives.

Like any recurring donors, those contributing through payroll giving programs should be thoroughly thanked for their support. Offer incentives such as personalized thank-you notes, badges, or recognition in your organization’s newsletters to establish a connection and set the group apart.

Additionally, you may consider creating a tiered recognition system that acknowledges payroll givers who reach certain donation or engagement milestones, ultimately recognizing and celebrating them for their involvement.

Final Thoughts

Payroll giving is a powerful tool that can significantly boost your nonprofit’s fundraising efforts. By taking a proactive approach to marketing these programs, your organization can tap into a steady stream of income while fostering long-term relationships with donors and their employers.

With the right approach, payroll giving can become a cornerstone of your nonprofit’s fundraising. Good luck!

Ready to learn about more workplace giving programs like payroll giving and beyond? Check out our recommended further reading:

- Get to Know the Basics of Corporate Matching Gift Programs. Learn the fundamentals of corporate matching gift programs. See how they work, why they’re beneficial for nonprofits, and how to maximize matching gift opportunities for your organization.

- Standout Strategies for Leveraging Corporate Volunteer Incentives. Discover effective strategies for leveraging corporate volunteer programs to benefit your nonprofit. This resource provides insights into how to engage supporters and maximize the impact of volunteer efforts.

- 8 Top Corporate Giving Trends to Watch + Examples. Stay ahead of the curve by understanding the latest trends in corporate and workplace giving. Uncover emerging practices in corporate philanthropy to align your nonprofit’s strategies with current trends and opportunities.