Promoting Payroll Giving FAQ: Strategies to Boost Revenue and Workplace Giving Participation

Many organizations face a common paradox: they have access to lucrative corporate funding channels that remain largely untapped simply because donors do not know they exist. For nonprofits looking to stabilize their income, raising awareness is just as critical as technical implementation.

Many organizations face a common paradox: they have access to lucrative corporate funding channels that remain largely untapped simply because donors do not know they exist. For nonprofits looking to stabilize their income, raising awareness is just as critical as technical implementation.

Payroll giving (or workplace giving) is a mechanism where employees authorize their employer to deduct automatic, recurring donations directly from their paychecks. For nonprofits, this is a uniquely powerful funding source that boasts high donor retention rates because of its simple, frictionless scheme.

In this guide, we will explore actionable methods to integrate payroll giving into your existing communications strategy. From optimizing your website to launching targeted email campaigns, we will discuss how to leverage fundraising software and storytelling to increase visibility, uncover matching gifts, and ultimately drive more sustainable revenue for your mission.

1. How can my nonprofit promote payroll giving to our supporters?

To promote payroll giving, consider doing the following:

- Create a dedicated payroll giving page with clear calls to action across your nonprofit’s website and email communications. This will help your supporters understand the process better.

- Add a payroll giving database to this page to help your donors identify their eligibility instantly.

- Mention payroll giving during campaigns and highlight benefits like recurring support.

Additionally, creating social media reminders can help keep your payroll giving program visible during busy giving seasons. Staff and volunteers can also reinforce messaging during events.

2. Where should my nonprofit promote payroll giving on our website?

The most effective way to promote payroll giving in your website is through a centralized workplace giving landing page.

Think of this page as a Hub, with a purpose to introduce the broad concept that employers offer various financial support programs. This main page provides a high-level overview of all corporate opportunities, such as matching gifts, volunteer grants, and payroll giving. From the hub, you include a specific call-to-action (e.g., “Want to donate directly from your paycheck?”) that links out to a dedicated payroll giving page.

This dedicated page is where you should host your deep-dive content, FAQs, and specific instructions. By organizing your site this way, you improve search engine optimization (SEO) for terms like “workplace giving” while ensuring supporters can easily find the specific program that fits their needs without getting overwhelmed.

3. How can my nonprofit use email campaigns to promote payroll giving?

Email campaigns should explain payroll giving benefits clearly and provide direct links to eligibility tools. Your nonprofit can include payroll giving reminders in donation receipts, and feature employer programs or highlight recurring commitments in monthly newsletters through a fundraising tool like Double the Donation’s searchable corporate giving database that you embed on your website, to reduce staff workload while guiding supporters to their employer program.

4. How can my nonprofit encourage employers to support payroll giving adoption?

While many companies offer open choice payroll giving programs that allow employees to give through these programs to any nonprofit or school of their choosing, companies may be willing to promote your nonprofit to their employees to increase visibility of your cause. If you have a specific partnership with a company, consider asking them to send employees information about your organization.

5. How can my nonprofit highlight matching opportunities connected to payroll giving?

Many payroll giving programs also include matching gifts which significantly increase donor impact. Your nonprofit should explain this clearly on your payroll giving page and integrate a fundraising tool that surfaces both payroll giving eligibility information and matching gift eligibility information in the same place. This ensures that supporters are aware of all the benefits that may be available to them through their employer.

You can cite specific examples by highlighting companies that frequently match gifts (such as Microsoft, Google, or Apple) to increase donor confidence. This approach drives higher conversion across corporate giving programs.

6. How can my nonprofit integrate payroll giving into our storytelling and campaigns?

Donors appreciate understanding how small recurring gifts support long-term programs. Your nonprofit can tell stories that highlight the recurring impact to encourage supporters to explore payroll deductions. Additionally, your campaign can feature “sustained giving” language which aligns naturally with payroll contributions. It also helps to incorporate payroll giving reminders during annual appeals, and simplify concepts for busy supporters through graphics and short videos.

7. What role do staff and volunteers play in promoting payroll giving?

Consistent messaging across all teams strengthens program visibility. Staff can mention payroll giving during stewardship calls and donor meetings, while volunteers can also spread awareness when interacting with supporters. To create a unified promotion strategy across departments, your nonprofit can conduct training sessions on fundraising tool integration to help staff understand how payroll giving works.

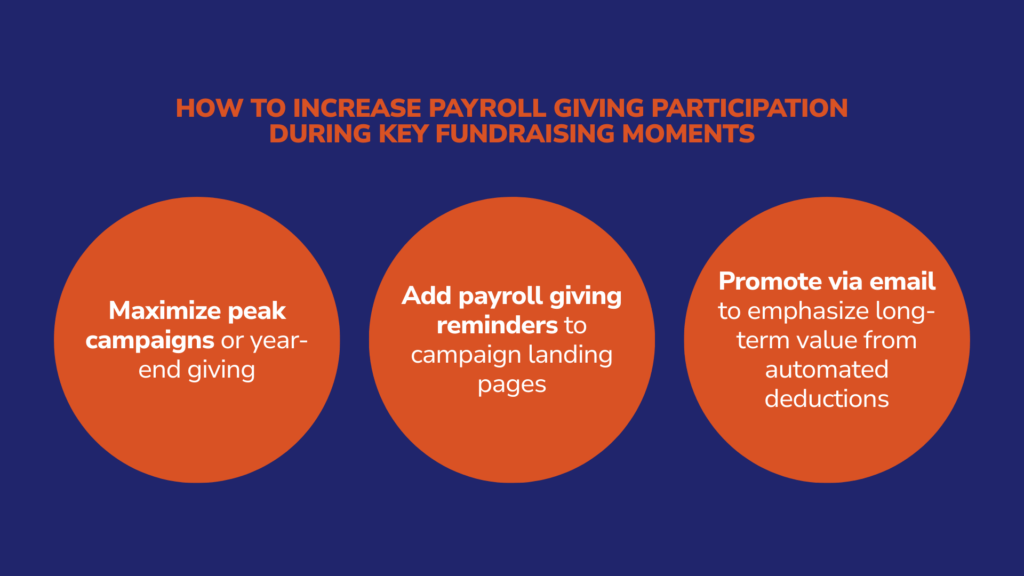

8. How can my nonprofit increase payroll giving participation during key fundraising moments?

Peak campaigns like GivingTuesday or year-end giving are prime opportunities to highlight payroll giving, because many supporters look for recurring giving options during these periods. On top of this, you can add payroll giving reminders to campaign landing pages and promote via email to emphasize long-term value from automated deductions.

9. How can my nonprofit measure the success of our payroll giving promotion strategies?

9. How can my nonprofit measure the success of our payroll giving promotion strategies?

To measure the success of your payroll giving promotion strategies, your nonprofit should:

- Track enrollment growth and recurring revenue trends

- Monitor monthly remittance reports to identify new payroll donors

- Check email engagement rates to help refine communication strategies

- Compare year-over-year payroll giving totals.

Promoting Payroll Giving to Maximize Revenue

Building a successful payroll giving pipeline is not a one-time task but an ongoing communication effort. When you consistently highlight workplace giving opportunities across your digital presence and stewardship interactions, you empower donors to make contributions that fit their financial lives and maximize their impact through a payroll match.

We recommend starting with a review of your current website to ensure payroll giving is not just listed, but actively explained. A small update to your website navigation can often lead to immediate engagement improvements.

To learn more about payroll giving and other forms of workplace giving, explore more resources from Double the Donation and implement best practices, streamline processes, and capture more payroll gifts today.